Get Help with Utility Assistance

LIHEAP applications will reopen on October 1, 2025.

Apply for LIHEAP applications at

click hereFlorida LIHEAP | Promise.

For any questions, please call 1-833-CSD-WILL and speak with an agent.

RENT & RELOCATION ASSISTANCE:

Intake Closed

At this time, our intake for rental and relocation assistance is closed because we have reached the maximum capacity for the current month. Due to high demand and limited funding, application slots fill very quickly.

The next opening date will be announced soon and posted on this website.

In the meantime, please consider the following resources:

Call 211 to connect with local community resources (food, utilities, emergency assistance, and nonprofits).

Utility (Electric) Assistance:

Apply here: https://floridaliheap.com/relief_program

Employment& Income Support:

Contact CareerSource Palm Beach County for job placement and training services.

Temporary employment agencies may also offer short-term work opportunities.

Housing Options:

If your rent is too high, consider room-sharing options to reduce housing costs.

Please Note:

Funding is very limited and applications are accepted on a first-come, first-served basis when intake reopens.

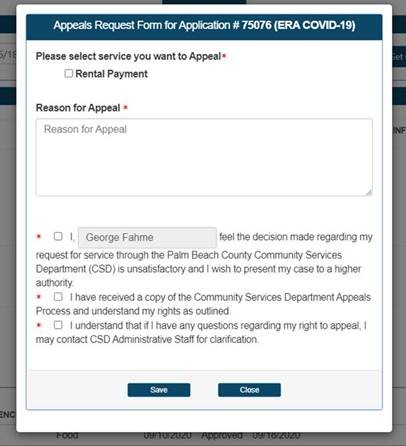

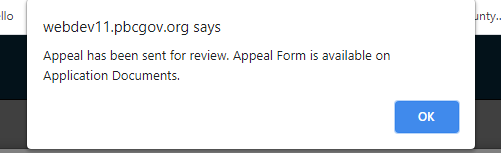

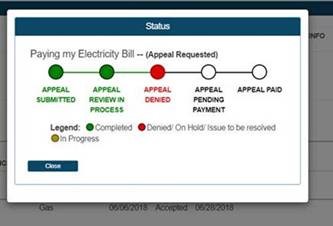

Appeals

How do I appeal if my application was denied?¿Cómo puedo apelar si mi aplicación fue denegada?

Kouman pou mwen fè rapèl si yo refize aplikasyon mwen an?

Samples of Supporting Documents

- Rental Lease Agreement

- Utility Company Bill Past Due for Each Month Requested

- Valid Government Issued ID

To promote independence of life in Palm Beach County by providing effective and essential services to residents in need.

Equity

Compassion

Integrity

Professionalism

Empowerment

A community where all residents of Palm Beach County have the resources and opportunities to achieve their full potential.

Contact Us

Palm Beach County

Community Services

810 Datura Street

West Palm Beach, FL 33401

561-355-4700

Under Florida law, e-mail addresses are public records. If you do not want your e-mail address released in response to a public records request, do not send electronic mail to this entity. Instead, contact this office by phone or in writing.